- Block Green Industry Weekly

- Posts

- Swiss Parliament to Explore Bitcoin Mining’s Energy Potential

Swiss Parliament to Explore Bitcoin Mining’s Energy Potential

Plus news from Bitcoin miners and IREN Q1

🇨🇭 Bern Parliament Approves Report on Bitcoin Mining Feasibility

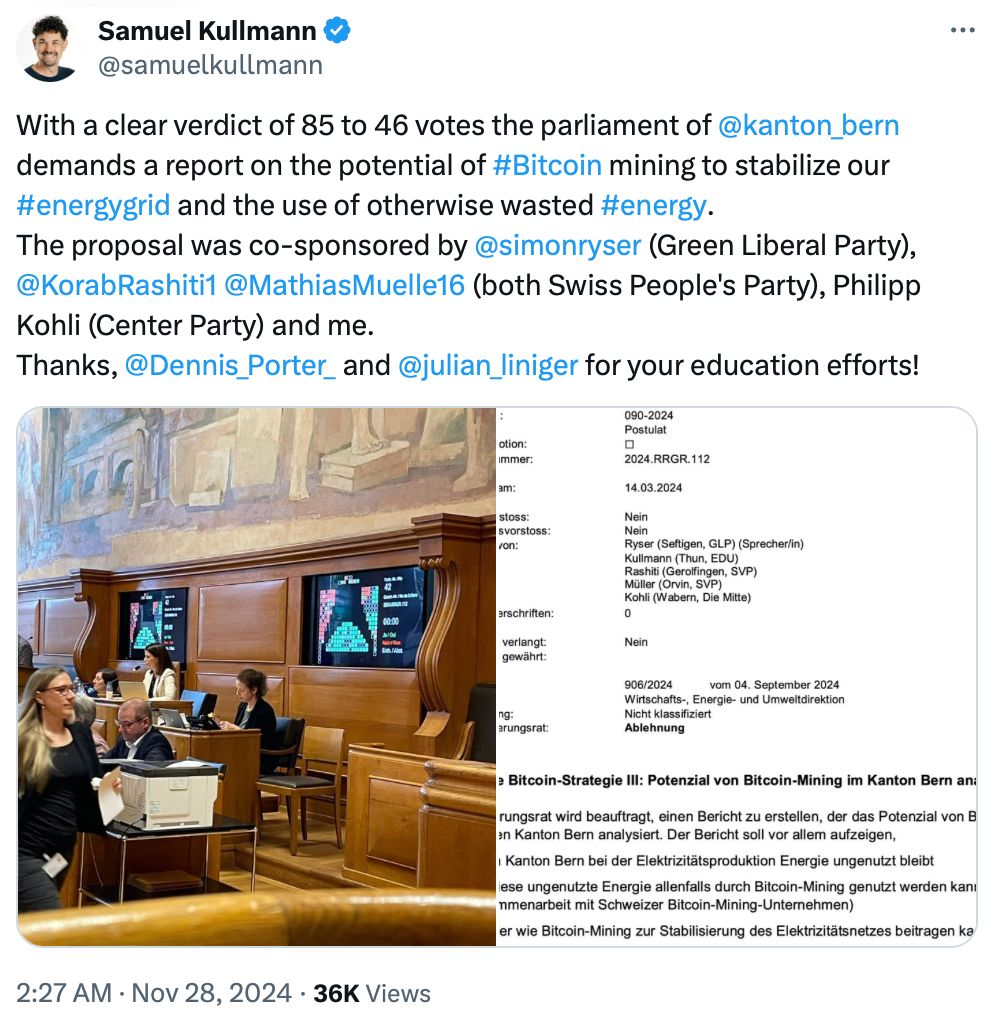

The parliament of Bern, Switzerland, has approved a motion to commission a report on the feasibility of Bitcoin mining, despite opposition from the canton’s executive authority, the Government Council. The proposal, introduced by the multiparty Bitcoin Parliamentary Group consisting of 23 members, passed with a vote of 85 to 46.

The report will examine how excess energy in the region could be utilized, explore potential partnerships with Swiss Bitcoin miners, and consider Bitcoin mining’s ability to enhance grid stability.

The Bitcoin Parliamentary Group highlighted Texas as a model for integrating Bitcoin mining into energy policy, emphasizing the potential to attract companies, create jobs, promote renewable energy, and stabilize the electricity grid.

However, the Government Council opposed the motion, arguing that energy consumption is a global issue, especially since Bern exports energy, and that demand from other data centers is growing.

They also pointed to Bitcoin's legal status, noting it is not recognized as legal tender and thus outside the Swiss National Bank’s purview.

Canton MP Samuel Kullmann acknowledged that debates on the proposal were influenced by "classic FUD arguments" but celebrated its approval as evidence of a shifting narrative around Bitcoin.

Dennis Porter, co-founder of the Satoshi Action Fund, contributed to the proposal, drawing on his experience in advancing pro-Bitcoin legislation in Pennsylvania.

Switzerland continues to solidify its reputation as a pro-crypto hub. Cities like Zug, home to the Ethereum Foundation, and Lugano, host of the annual Plan B Forum, remain central to the blockchain and cryptocurrency ecosystem.

⛏️ In the News

Publicly traded Bitcoin mining companies have spent $3.6b on plant, property, and equipment in 2024, focusing on hardware upgrades to maintain profitability amid increasing reliance on debt financing.

The U.S. Customs and Border Protection is holding shipments of Bitmain Antminer ASICs at ports, reportedly due to a Federal Communications Commission request linked to sanctions concerns, leaving miners facing delays and hefty holding fees.

MARA has urged the US to accelerate efforts to secure Bitcoin dominance through strategic reserves, domestic mining, and hardware production, framing it as a critical national security issue amidst rising global competition.

A quantum breakthrough by Microsoft and Atom Computing hints at the potential for quantum systems to revolutionize blockchain proof-of-work, possibly surpassing classical mining within decades.

A misdirected Bitcoin mining climate tax proposed at the UN climate summit could unfairly target the industry, focusing on its energy consumption while overlooking Bitcoin mining's benefits for the energy market and failing to address the broader issue of underinvestment in energy infrastructure and supply.

Q3 Update

👁️🗨️ IREN

IREN reported Q1 FY25 results with revenue of $54.39m, missing by $364.75K. Bitcoin mining revenue was $49.6m, a decline YoY of 8.65%.

AI Cloud Services revenue grew by 28% YoY to $3.2m, driven by additional GPU deployments in April 2024.

Adjusted EBITDA decreased by 78.7% YoY to $2.6m, down from $12.2m in Q4 FY24.

The company mined 813 Bitcoins, a slight decrease of YoY 1% from 821 Bitcoins mined in Q4 FY24.

Net electricity costs increased by 19.1% YoY to $28.7m, compared to $24.1m in Q4 FY24.

IREN is transitioning to a U.S. domestic issuer in 2025 and is focusing on alternative funding instruments.

The company is on track to reach 31 EH/s in Bitcoin mining and plans to accelerate expansion to 50 EH/s by H1 2025.

IREN's cash balance increased to $182.4m as of October 31, 2024, with no debt facilities.

Q1 FY25 net loss after tax was $51.7m, compared to a loss of $27.1m in Q4 FY24.