- Block Green Industry Weekly

- Posts

- Bitcoin Miner Equity Money Rain During Q1

Bitcoin Miner Equity Money Rain During Q1

Plus: Venezuela bans mining, US miners consider MENA, JPMorgan reports on mining market, DMG Q2 report

Here's what happened in the world of mining this week:

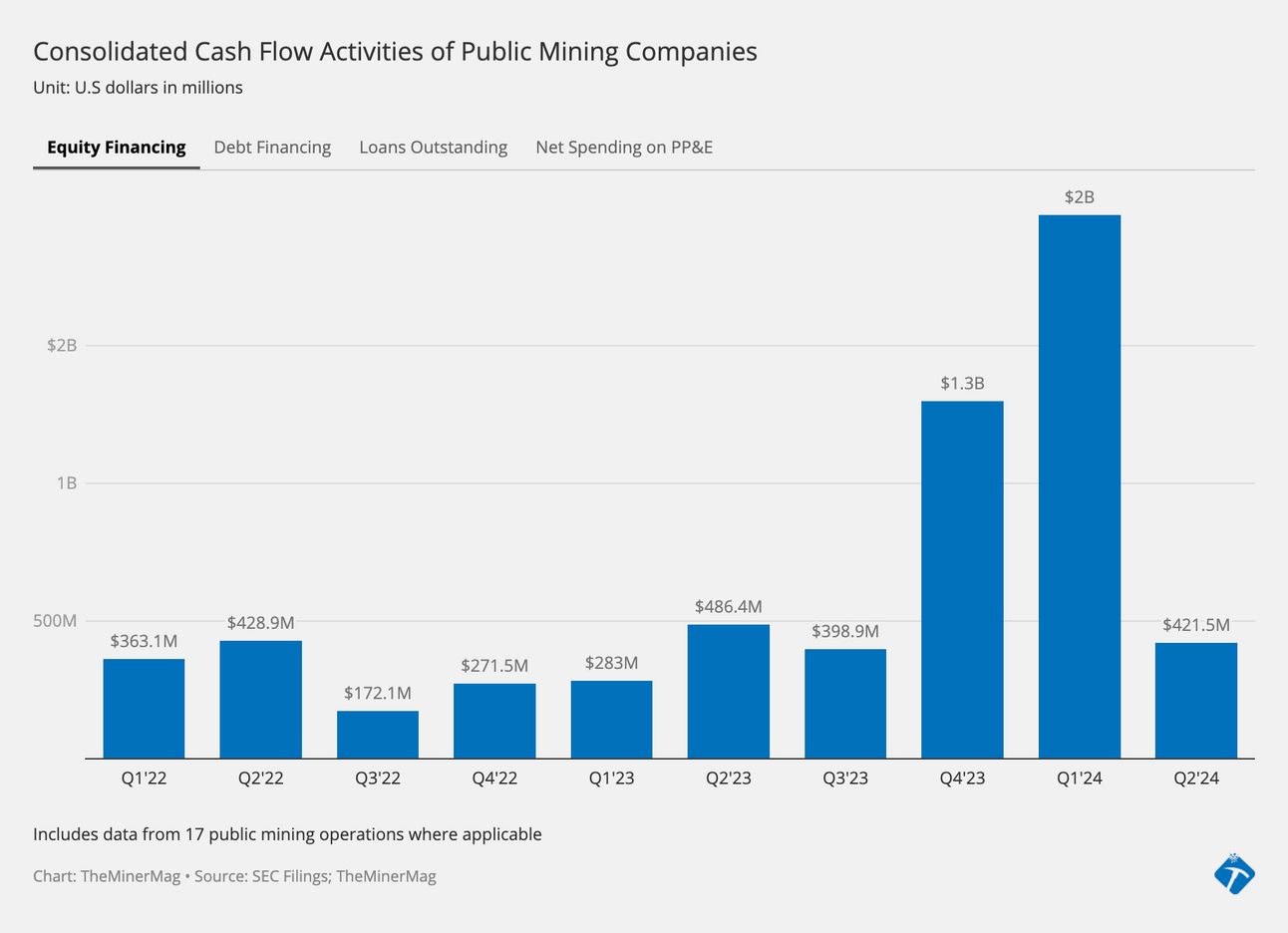

🤑 BlocksBridge reported on $2b in equity funding raised pre-halving

🛑 Venezuela bans crypto mining and seizes assets

🐫 The Middle East welcomes US miners as the government proposes a 30% tax

🧑🌾 Abu Dhabi Food Safety Authority bans farmers from mining

🏦 JPMorgan shares their opinion on Bitcoin miners post-halving

😓 Risk of centralization more evident post-halving

📜 DMG publishes their Q2 with a 31% rise in revenues

💵 Bitcoin Miners Stock Up on $2b in Cash Before Halving

Public Bitcoin mining companies secured a combined $2b in equity funding in preparation for the halving.

This funding surge happened in the last quarter of 2023 (Q4 2023) with companies like Marathon Digital, CleanSpark, and Riot Platforms leading the pack.

Funding activity is expected to be significantly lower in Q2 2024 with estimates suggesting less than $500m invested so far (as of mid-May).

Despite missing earnings estimates, some mining companies like Riot Platforms still saw significant profit increases compared to the same period last year.

🇻🇪 Venezuela Bans Bitcoin Mining and Seizes 11,000 ASICS

Venezuela's government announces a ban on mining and seizes 11,000 ASICs.

The move aims to disconnect all cryptocurrency mining farms from the electrical system to alleviate strain on the grid.

Bitcoin's energy-intensive nature strains Venezuela's unreliable electricity supply, worsened by years of U.S. sanctions and mismanagement.

Despite the crackdown on mining, Venezuela's government is supportive of cryptocurrencies, using them in state-owned PDVSA (oil industry company) for international oil trade to evade sanctions.

🐫 Middle East Rolls Out the Red Carpet for US Miners

Facing a proposed 30% tax on their electricity use in the US, miners are worried about profitability and considering a shift in operations.

The Middle East is emerging as a potential new home for Bitcoin mining, offering lower taxes, abundant energy resources, and less stringent environmental regulations.

Oman is a prime example, with government investment in crypto mining and favorable climate conditions in some areas. Existing and upcoming facilities like Green Data City's 150 MW mining farm.

If the US tax bill passes, it could lead to a decline in US dominance of Bitcoin mining, with the Middle East poised to take over as a new hub.

However, uncertainties remain. The fate of the US tax bill and its ultimate impact are unclear, as is the overall attractiveness of the US for mining businesses despite the current regulatory climate.

🥕 Abu Dhabi Outlawed Mining on Farms

In a surprising move, Abu Dhabi, UAE has outlawed crypto mining on farms.

The Abu Dhabi Agriculture and Food Safety Authority (Adafsa) issued an official warning to farmers, highlighting the hefty fines of up to $2800 for violating the regulation.

The primary concern behind the ban is the energy consumption associated with crypto mining. Adafsa fears this could lead to a significant spike in electricity bills for farms, jeopardizing their financial stability.

JPMorgan estimates that mining cost for Bitcoin has dropped to about $45,000 from above $50,000.

The temporary surge in transaction fees and miner revenues from the Runes protocol has faded, with user activity and fees dropping significantly over the past few weeks. As fees and activity decreased, power consumption fell more than the hashrate, indicating that miners were going offline.

JPMorgan sees limited upside for Bitcoin prices in the near term due to various headwinds, including a lack of positive catalysts and reduced retail investment.

🐍 Bitcoin Halving Squeeze and Network Centralization

Bitcoin halving delivers financial blow to miners as transaction fees and overall revenue plummet after the hype around non-fungible-like tokens faded. Miners face pressure to cut costs, secure cheaper energy sources, or even shut down, potentially leading to network centralization concerns.

Relocation of mining operations to areas with cheaper electricity (e.g., Ethiopia).

The number of Bitcoin nodes has decreased by 6.92%, raising concerns about network centralization as fewer independent entities maintain the network's integrity.

Uncertainties remain regarding the long-term impact of miner exodus on Bitcoin network stability and the success of miners venturing into new fields.

📰 DMG Reports Q2

Q2 2024 revenue: $10m, a 31% YoY increase, just in the green in Net Income.

Mined 153 bitcoin, down 22% from the previous quarter.

Currently operating 0.96 EH/s, they aim to deploy new Bitmain T21 miners to reach 1.7 EH/s by June, with the long-term target set at 2 EH/s.

They currently sit on $43.6m in cash and crypto.

CEO emphasizes strategic investments in carbon-neutral bitcoin transactions and mining operations expansion.