- Block Green Industry Weekly

- Posts

- IMF Halts Pakistan's Bitcoin Mining Subsidies

IMF Halts Pakistan's Bitcoin Mining Subsidies

PLUS IMF blocks Pakistan and June production updates

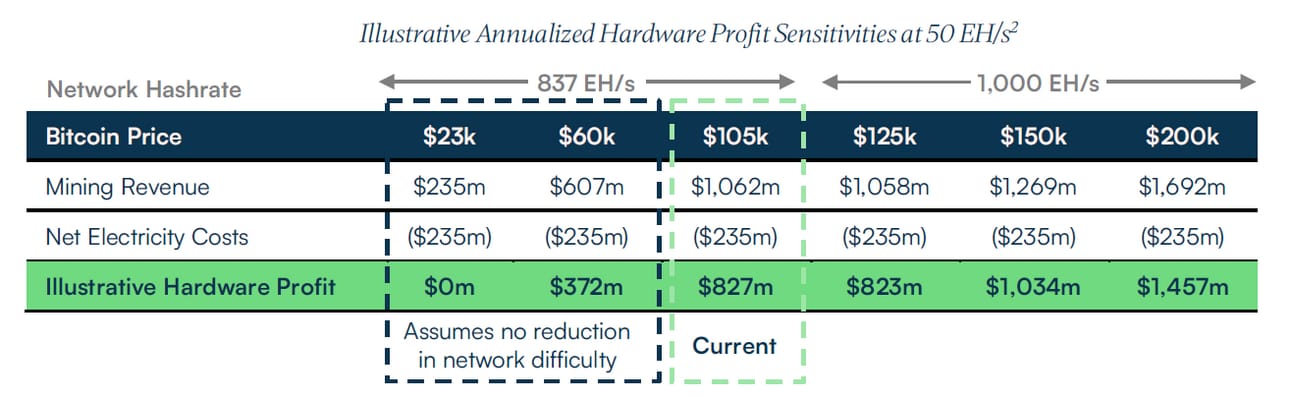

📈 IREN Achieves Mid-Year Target of 50 EH/s

IREN reached 50 EH/s of installed Bitcoin mining capacity, mainly through its 750 MW Childress site, currently operating at 650 MW.

The Childress site will also support a 50 MW liquid-cooled AI data center, Horizon 1, planned for Q4 2025.

Last quarter, the all-in cash cost per BTC mined was $41,000, driven by efficient hardware (15 J/TH), scale, low-cost renewable energy, and vertical integration.

Recent hardware refresh means no near-term capital expenditure for mining equipment, maximizing free cash flow. Convertible notes are the only non-equity financing, preserving flexible capital for future growth.

The company plans to leverage its mining infrastructure and operational expertise to expand into high-performance AI computing markets.

💵 IMF Puts Brakes on Pakistan's Bitcoin Power Subsidies

Pakistan’s plan to use surplus electricity for Bitcoin mining is in limbo after the IMF reportedly rejected a proposal to offer subsidized power to energy-intensive sectors, warning it could destabilize the country's already fragile energy market.

Despite having excess electricity, especially in winter, the IMF is concerned that pricing schemes like the proposed marginal-cost tariff of $0.08 per kWh could distort the energy sector and create economic imbalances.

While the initiative, backed by the Pakistan Crypto Council and Ministry of Finance, aimed to boost demand and attract investment in Bitcoin mining and AI, the IMF has compared it to past sector-specific incentives that proved problematic.

The proposal is now under review by the World Bank and other partners, with Pakistani officials continuing to refine the plan. Meanwhile, Pakistan’s crypto strategy also includes plans to build a national Bitcoin reserve and grow it through DeFi yields, reflecting the government’s broader ambitions in digital transformation.

🗞️ In the News

Hut 8 has energized Vega, a 205 MW Texas facility believed to be the world’s largest single-building Bitcoin mining site, featuring direct-to-chip liquid cooling and up to 15 EH/s of next-gen ASIC compute.

Hut 8 has secured 5-year contracts with the Ontario Independent Electricity System Operator (IESO) for 310 MW of power generation from its four natural gas-fired plants in Ontario, stabilizing revenue and positioning them for long-term relevance in a growing energy market.

American Bitcoin has raised $220m, partly in BTC, to fund mining expansion and grow its BTC treasury, while also preparing to go public via a merger with Gryphon Digital Mining.

BitMine Immersion Technologies has raised $250m to launch an Ethereum-focused corporate treasury, marking a strategic pivot from its previous Bitcoin-centric approach amid growing institutional interest in ETH.

Bitcoin miner production declined in June as firms like Riot, Cipher, and MARA curtailed operations in Texas to avoid peak power costs and weather disruptions, while CleanSpark bucked the trend with a production increase.

Standard Chartered expects Bitcoin to reach $135,000 by the end of Q3 2025 and $200,000 by year-end, citing strong ETF inflows and corporate treasury buying as new drivers that offset traditional halving cycle trends.

Metaplanet has become the fifth-largest corporate BTC holder after purchasing 1,005 BTC for $108m, surpassing CleanSpark and bringing its total holdings to 13,350 BTC, funded in part by issuing $208m in 0% interest bonds to expand its BTC treasury.

📰 Miner June Update

🏃 MARA

MARA reported a 25% MoM decrease in BTC production for June 2025, yielding 713 BTC compared to 950 BTC in May.

Total hashrate saw a slight 2% decrease, settling at 57.4 EH/s in June from 58.3 EH/s in May. Despite the production dip, MARA increased its total BTC holdings by 1.6% to 49,940 BTC as of June 30, 2025, opting not to sell any Bitcoin during the month.

Looking ahead, MARA aims to achieve a hashrate of 75 EH/s by the end of 2025, representing over 40% growth from 2024, supported by existing machine orders.

The goal is underpinned by their substantial captive capacity of 1.7 GW, with 1.1 GW currently operational, and a growth pipeline exceeding 3 GW of low-cost power opportunities.

👮 Riot

Riot Platforms produced 450 BTC in June 2025, marking a 12% MoM decrease from May's production of 514 BTC, though it represents a substantial 76% increase YoY.

They held 19,273 BTC at the end of June, a significant 106% increase YoY. The company sold 397 BTC in June, generating $41.7m in net proceeds.

The company's deployed hashrate held steady at 35.5 EH/s, while the average operating hashrate saw a 5% decrease MoM to 29.8 EH/s.

Riot significantly increased its power credits to $5.6m in June, a 141% increase from May, primarily due to higher estimated power curtailment credits as the ERCOT's Four Coincident Peak program began. This also contributed to an 11% decrease in their all-in power cost per kWh.

⛓️ DMG

DMG Blockchain Solutions mined 23 BTC in June 2025, representing a 25.8% MoM decrease from May's 31 BTC, primarily due to an unscheduled two-day electrical outage and ongoing issues with its hydro infrastructure. BTC holdings decreased by 2.6% to 341 BTC by the end of June.

The company's realized hashrate also dropped by 17.5% to 1.56 EH/s from 1.89 EH/s in May.

DMG is actively addressing the hydro infrastructure challenges, including contamination issues, and plans to source new hydro infrastructure. The company aims to build a pilot system this summer and targets growing its hashrate to 3 EH/s by the end of 2025.

DMG has executed a binding agreement for a new Bitcoin mining site in a Canadian province outside of British Columbia, which is expected to add approximately 1 EH/s of Bitcoin mining capacity by the second half of 2026.

🦘 Cango

Cango Inc. produced 450 BTC in June 2025, a 7.12% decrease MoM. The company's total BTC holdings increased to 3,879 as of the end of June.

Deployed hashrate remained constant at 32 EH/s in June, with a slight increase in the average operating hashrate to 29.92 EH/s from 29.86 EH/s in May.

They completed the acquisition of additional ASICs on June 27, 2025, adding 18 EH/s to their operations. This acquisition significantly boosts Cango's total hashrate to 50 EH/s.