- Block Green Industry Weekly

- Posts

- 🇺🇲 How Trump’s Tariffs Will Affect Bitcoin Mining by Hashlabs

🇺🇲 How Trump’s Tariffs Will Affect Bitcoin Mining by Hashlabs

PLUS Miner news and update from IREN

📙 How Trump’s Tariffs Will Affect Bitcoin Mining by Hashlabs

In a new article by Jaran Mellerud of Hashlabs, the impact of Donald Trump’s newly announced import tariffs is examined through the lens of Bitcoin mining and the outlook isn’t rosy for U.S. miners.

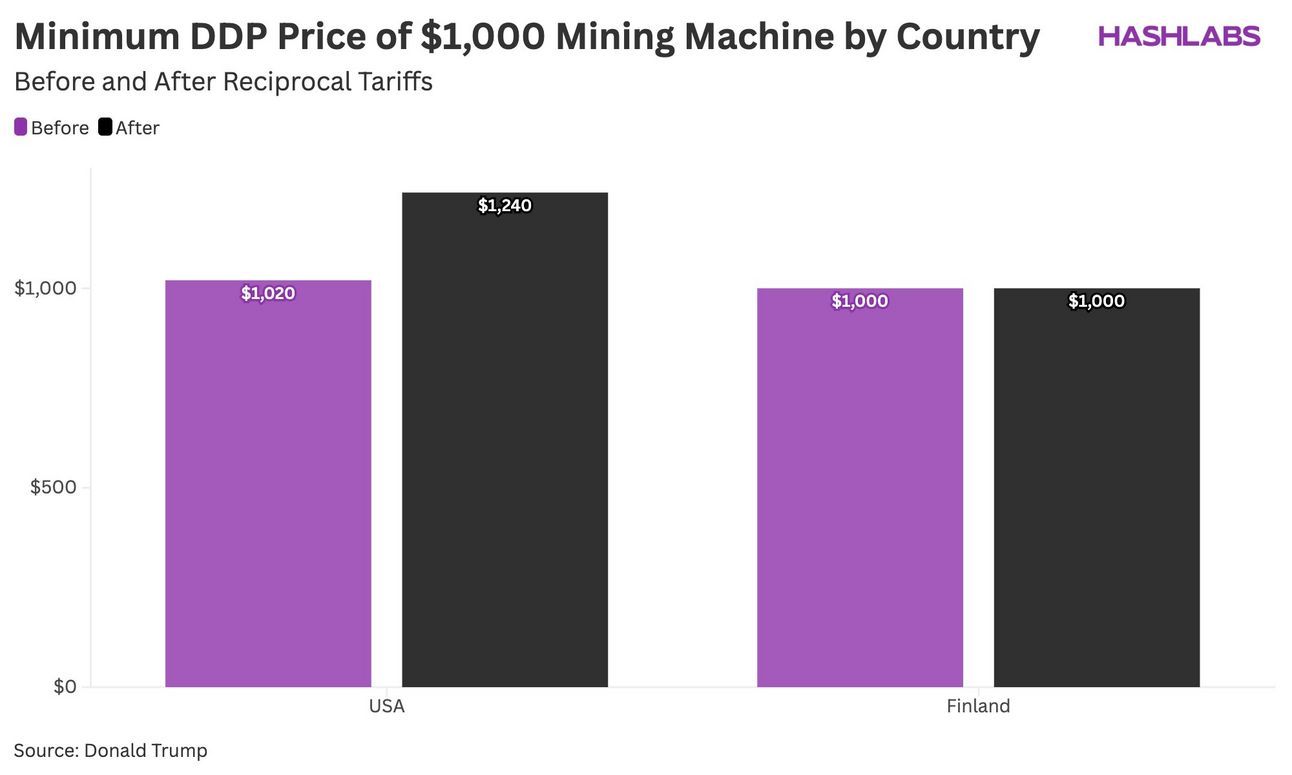

The U.S. currently hosts around 36% of the global hashrate, but with new tariffs hitting Southeast Asian imports, machine prices in the U.S. are expected to rise by 22–36%. As domestic inventories run low, this price gap will widen, potentially making mining unprofitable for many operators.

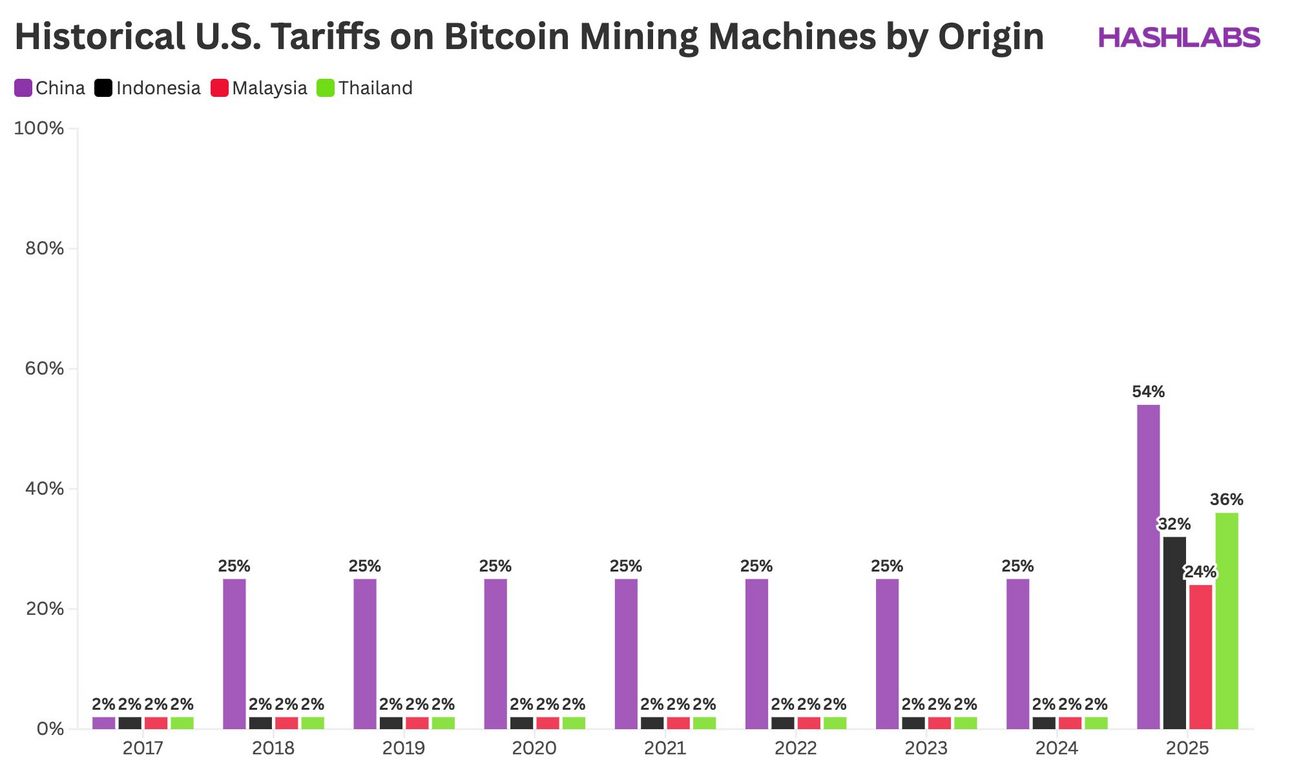

Historically, miners and manufacturers dodged earlier tariffs by moving production out of China to lower-tariff countries like Thailand and Malaysia. But with those countries now hit by the new tariffs as well, that loophole has closed. Meanwhile, machine prices elsewhere, like in Europe, remain unchanged, giving international miners a cost advantage.

The tariffs also threaten to stall hashrate growth in the U.S. and shake investor confidence. Even if reversed, the abrupt nature of the policy change undermines the long-term predictability that capital-intensive mining operations rely on.

Some relief may come from domestic assembly: MicroBT already has U.S. production lines, and chips from Taiwan remain untariffed. But full-scale domestic manufacturing remains a long-term goal at best, hindered by high costs and a lack of advanced chip fabrication capacity.

In short, Mellerud argues, the U.S. may be heading into a period of slower growth and declining share of global hashrate, potentially opening the door to a more geographically distributed mining landscape.

The most obvious impact of these tariffs - a significant price hike for mining machines in the US. Importing machines to the US will now cost at least 24% more compared to tariff-free countries like Finland

🗞️ In the News

Bit Digital has acquired a $53.2m facility in North Carolina as part of its ongoing pivot into AI and high-performance computing.

Public Bitcoin miners sold over 40% of their BTC holdings in March - the highest since October 2024—as rising operational costs and looming trade tariffs force firms to liquidate assets and rethink their strategies.

Auradine has raised $153m in an oversubscribed Series C round to expand its AI and Bitcoin mining infrastructure offerings, while launching a new business unit focused on energy-efficient data center networking.

CleanSpark is shifting to a self-funding model by selling part of its mined BTC and securing a $200m credit line from Coinbase Prime.

Bitdeer is ramping up self-mining and planning US-based rig manufacturing to counter weak hardware sales and potential import tariffs amid market volatility and post-halving challenges.

Bitdeer has acquired 40MW of liquid-cooled mining containers from Saiheat to host its Sealminer rigs, expanding its Bitcoin mining operations globally.

👁️ IREN Limited Expands Bitcoin Mining Capacity to 40 EH/s with Strategic Investments

IREN expanded its Bitcoin mining capacity from 37 EH/s to 40 EH/s by adding new mining rigs at its Childress Phase 4 data centers, bringing the total site capacity to 150 MW.

The company has set a target of reaching 50 EH/s by the first half of 2025, demonstrating a strong commitment to scaling up its mining operations.