- Block Green Industry Weekly

- Posts

- Enterprise Bitcoin Adoption on A Steep Climb

Enterprise Bitcoin Adoption on A Steep Climb

PLUS miner news and US Crypto Week

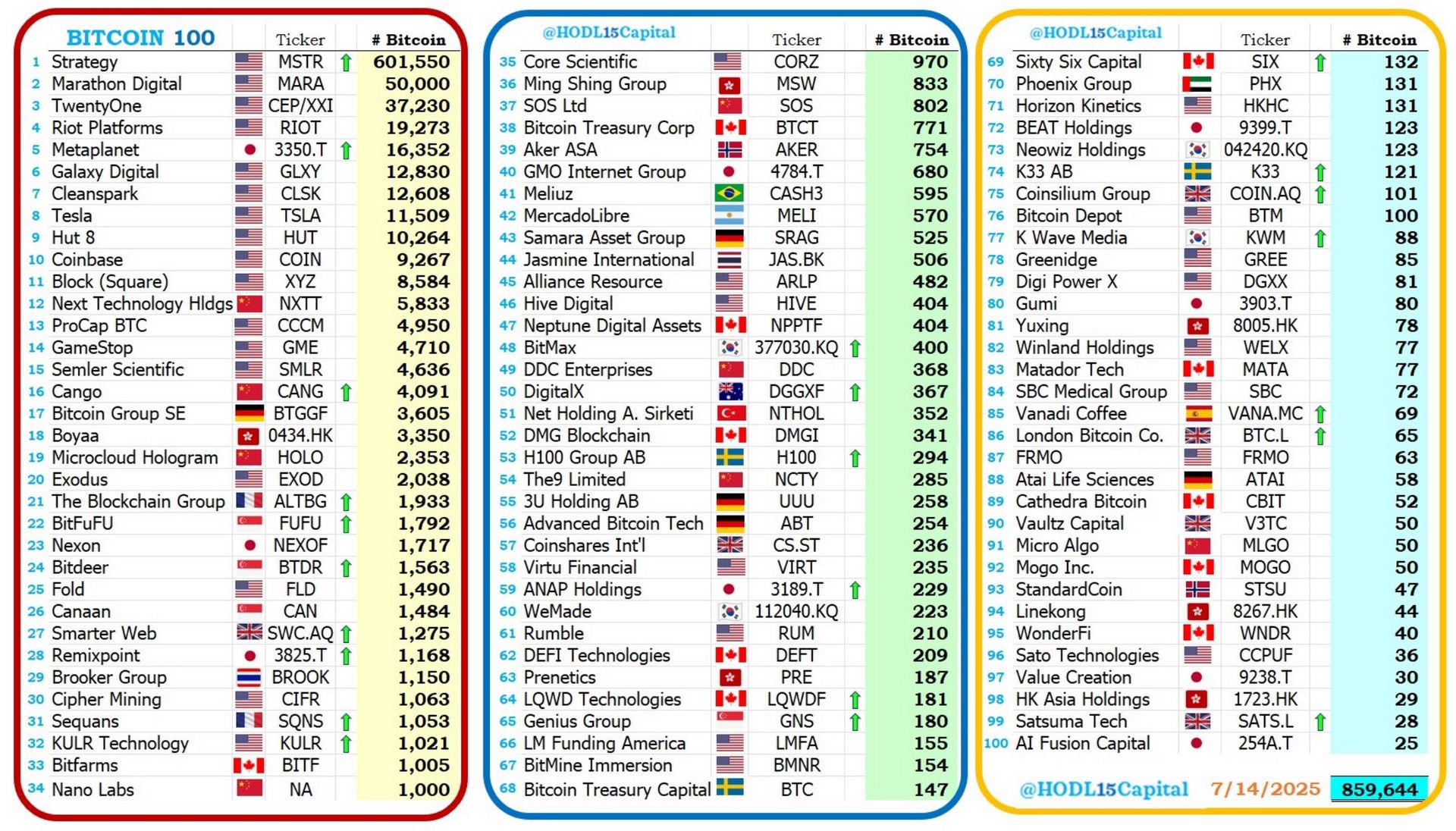

🏦 The Bitcoin Treasury Trend Accelerates

Blockware Intelligence projects a significant increase in corporate Bitcoin adoption, forecasting that at least 36 more public companies will add BTC to their balance sheets by the end of 2025, a roughly 25% increase from the current total of 141. The firm's Q3 2025 market update report highlights that corporate Bitcoin adoption has already surged 120% in 2025 alone.

Michael Saylor's MicroStrategy remains the leading corporate holder with an impressive 597,325 BTC. This is approximately 12 times more than the second-largest holder, MARA, which holds nearly 50,000 BTC as of June 30, 2025. Over the past 30 days, there has been a 2.43% uptick in BTC treasury holdings.

Blockware Intelligence notes that this wave of corporate adoption is largely driven by either newly established companies or those facing business challenges. They suggest that companies with "struggling core businesses" find it easier to see the value in allocating retained earnings to BTC, potentially earning a 40% to 60% compound annual growth rate (CAGR) without the operational risks associated with their primary business.

While the market is clearly signaling that "securitized BTC exposure is here to stay," with Bitwise Asset Management reporting a record 159,107 BTC added to corporate balance sheets in Q2 2025, not everyone is entirely optimistic. Glassnode’s lead analyst James Check, for instance, believes that “the Bitcoin treasury strategy has a far shorter lifespan than most expect.” Similarly, venture capital firm Breed warns that only a few Bitcoin treasury companies will likely "stand the test of time" and avoid a "death spiral." Crypto trader Saint Pump also anticipates that BTC-holding companies will play a “key role in the next bear market.”

This trend reflects a broader shift in how businesses are approaching treasury management and asset diversification.

🗞️ In the News

🔄 MARA Boosts BTC Yield Through Strategic Investment MARA acquired a minority stake in Two Prime, an institutional investment adviser, for $20m in equity, significantly increasing its Bitcoin allocation with the firm from 500 BTC to 2,000 BTC for yield generation.

⚡ Hut 8 Rebrands as Energy Infrastructure Leader Hut 8 announced a rebrand to better reflect its core identity as an energy infrastructure platform focused on integrating power, digital infrastructure, and compute for next-generation, energy-intensive applications.

🇧🇹 Bhutan Takes Profits as BTC Hits New Highs Bhutan's government, through its investment arm Druk Holding, has transferred $74.24m worth of BTC to Binance over the past two weeks, a move that coincides with Bitcoin reaching new all-time highs and suggests the nation is capitalizing on its crypto investments.

🐶 Bit Origin Plans $500m Dogecoin Treasury Move

Bitcoin mining firm Bit Origin is diversifying its treasury by aiming to raise $500m for Dogecoin (DOGE) purchases, causing its stock to surge 90% following the announcement.☢️ France to Launch Nuclear-Powered Mining Pilot France is planning a five-year pilot program to leverage surplus nuclear energy for Bitcoin mining, intending to stabilize its electricity grid, cover nuclear fleet maintenance, and generate substantial revenue.

🪙 Bit Digital Expands Ethereum Holdings

Bit Digital announced it had increased its Ethereum holdings to approximately 120,306 ETH.

🏈 US Crypto Legislation Propels Market to $4 Trillion High

In a landmark "Crypto Week" for the digital asset space, the US House of Representatives has passed three pivotal bills, driving the total crypto market capitalization to an unprecedented $4 trillion. These legislative victories, strongly backed by President Donald Trump and Treasury Secretary Scott Bessent, aim to solidify the US's position as a global leader in digital assets and address long-standing regulatory uncertainties.

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act has cleared the House and is now headed to the President's desk for signature. This bill establishes a robust regulatory framework for stablecoin issuers, mandating reserve backing and strict oversight, with bipartisan support highlighting a consensus on the need for clear stablecoin rules.

Concurrently, the House also passed the Anti-Central Bank Digital Currency (CBDC) Act, which directly prohibits the Federal Reserve from issuing a US central bank digital currency. This bill reflects concerns over potential surveillance risks and government overreach associated with CBDCs and will now proceed to the Senate.

Finally, the CLARITY Act (H.R. 3633) received overwhelming approval in the House with a vote of 294-134. This legislation seeks to define and delineate regulatory oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) for digital commodities like Bitcoin. Proponents argue it will foster innovation by providing clear rules of the road for businesses and offer essential consumer protections in what has often been described as the "wild, wild west" of the crypto market. If passed by the Senate, the CLARITY Act is expected to be a significant milestone in federal crypto regulation.

The market has responded positively to this legislative momentum. BTC briefly topped $120,000 again, while Ethereum (ETH) surged 8% to over $3,600, marking a 40% gain in the past fortnight. The Ripple cross-border token XRP also saw a dramatic increase, skyrocketing almost 20% on the day to a year-to-date high of $3.64.

This surge in prices and ETF inflows signals growing institutional confidence and optimism for continued growth in the crypto industry, as these bills are seen to pave the way for broader adoption and integration of digital assets into the traditional financial system.