- Block Green Industry Weekly

- Posts

- Could Bitcoin Have Prevented Spain's Blackout?

Could Bitcoin Have Prevented Spain's Blackout?

PLUS Miner news and updates from Bitfarms, RIOT

🇪🇸 No Blackouts with Bitcoin Miners

A recent University of Cambridge report suggests that Bitcoin mining can be a key contributor to electrical grid resilience by offering a demand-based strategy for network managers, as highlighted by the blackout in Spain.

The report, based on a survey representing a significant portion of hashrate, indicates that miners can instantly disconnect from the grid, acting as a "luxury fuse" to balance electricity supply and demand, which is increasingly crucial with the growth of intermittent renewable energy.

Notably, in 2023, 57% of surveyed miners shut down on demand, returning 888 GWh to the grid, a flexibility that led Texas' grid operator (ERCOT) to cancel plans for new gas plants due to the reliable 3 GW that miners can provide.

Globally, Bitcoin mining consumes 0.54% of electricity, with a majority (52.4%) coming from sustainable sources, often utilizing otherwise wasted energy at an average cost of $0.045 per kWh.

While authorities in Spain and Portugal are still investigating the exact cause of the blackout, the event underscores the challenges of managing power grids with a high penetration of renewables and the need for advanced demand response mechanisms.

Proponents suggest that integrating Bitcoin mining into the grid infrastructure, alongside other solutions like battery storage, could enhance resilience and help avoid future widespread outages by providing a readily available and economically incentivized load-balancing tool.

Furthermore, Bitcoin mining's ability to utilize otherwise wasted renewable energy can improve the financial viability of green energy projects and contribute to a more sustainable energy transition.

🇩🇪 Deutsche Telekom Pioneers Green Bitcoin Mining Project in Germany

German telecommunications giant Deutsche Telekom, through its tech division MMS, has partnered with Bankhaus Metzler and RIVA Engineering to launch a pioneering Bitcoin mining project in Germany utilizing surplus renewable energy.

This initiative, dubbed "digital monetary photosynthesis" by Deutsche Telekom's Oliver Nyderle, aims to demonstrate how Bitcoin mining can serve as a flexible tool for regulating power grids dealing with fluctuating renewable energy sources, similar to successful implementations in the US and Finland.

The project highlights the potential of Bitcoin mining to convert excess energy into digital value and contribute to grid stability, a concept underscored by Bankhaus Metzler's Hendrik König as blockchain technology gains broader significance beyond the financial sector.

🗞️ In the News

UAE-based Phoenix Group has expanded its mining capacity in Ethiopia by 52 MW, bringing its total operational power in the country to 132 MW and its global capacity to over 500 MW, leveraging low-cost, renewable energy sources.

Swiss National Bank chief Martin Schlegel dismissed calls to include BTC in the bank's reserves, citing concerns about its stability and security as it does not currently meet their requirements for currency reserves.

Galaxy Digital intends to begin trading on the Nasdaq on May 16 under the ticker GLXY to broaden their investor base and provide easier access to the crypto and AI ecosystems, pending shareholder and Nasdaq approval.

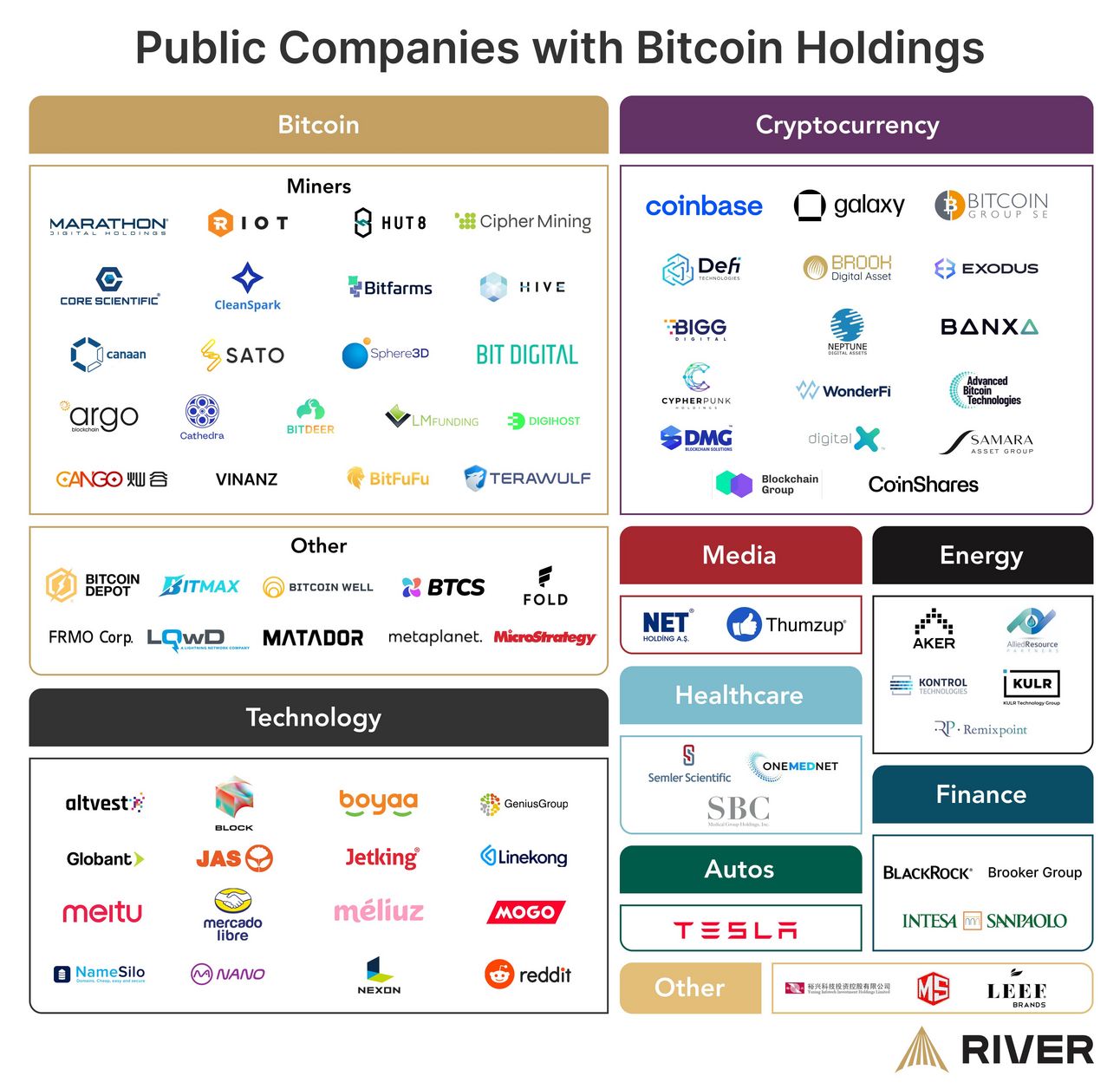

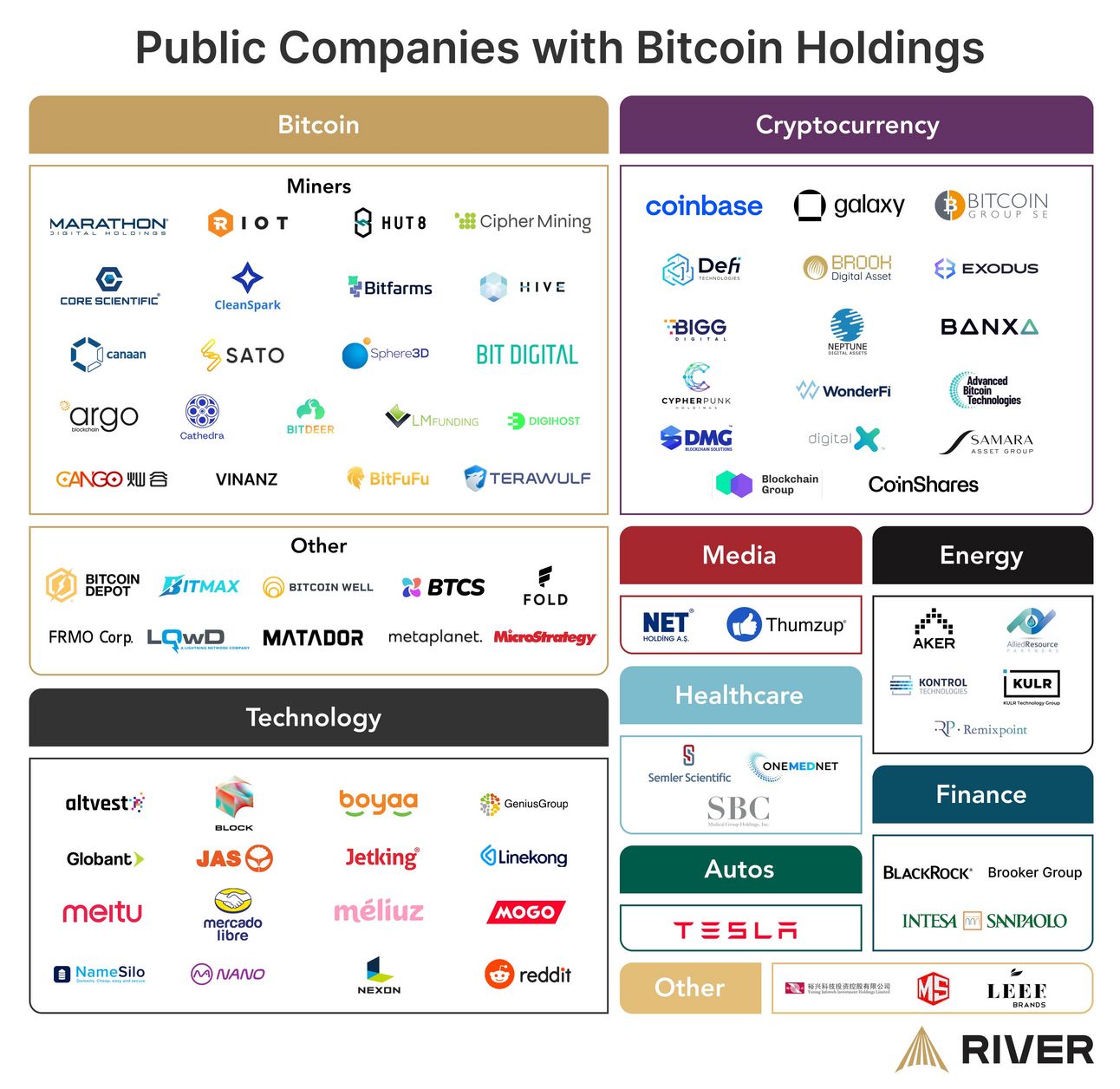

Grayscale has launched a Bitcoin Adopters ETF that tracks companies with Bitcoin treasury strategies or significant BTC holdings, including miners and other firms across various sectors.

📆 Miner Updates

🧑🌾 Bitfarms April

Secured up to $300m in private debt financing from Macquarie Group to develop HPC data center at Panther Creek.

Achieved an operational hashrate of 19.5 EH/s with a power efficiency of 19 w/TH per terahash. Mined 268 BTC in April, averaging 8.9 BTC per day.

Ended April with 1,005 BTC in treasury, valued at $94m.

Experienced a 5% increase in average operational hashrate to 17.2 EH/s compared to March. Maintained an energized capacity of 461 MW.

🚨 RIOT Q1 2025

Total revenue reached a record $161.4m, demonstrating a significant 103.52% YoY increase compared to $79.3m in Q1 2024.

Bitcoin mining generated $142.9m in revenue, a substantial YoY increase from $71.4m in the same period last year.

The company produced 1,530 BTC during the quarter, an increase from the 1,364 BTC mined in the first quarter of 2024.

The average cost to mine each BTC, excluding depreciation, increased YoY to $43,808 from $23,034.

Engineering revenue saw a significant YoY increase to $13.9m from $4.7m. Riot’s engineering segment designs and manufactures power distribution equipment and custom-engineered electrical products, serving large-scale commercial and governmental customers

Riot maintained a strong financial position with $310.3m in working capital, including a substantial $163.7m in unrestricted cash on hand, along with $74.2m in restricted cash and $71.0m in marketable equity securities.

The company held 19,223 unencumbered BTC as of March 31, 2025, which were valued at approximately $1.6b.