- Block Green Industry Weekly

- Posts

- Chinese Bitcoin ASIC Giants Shift Production to U.S. Amid Tariffs and Trade Tensions

Chinese Bitcoin ASIC Giants Shift Production to U.S. Amid Tariffs and Trade Tensions

PLUS miner news and HIVE update

🇨🇳 Chinese Bitcoin ASIC Giants Move Production to U.S. to Counter Tariffs and Trade Tensions

Facing mounting pressure from U.S. tariffs and customs enforcement, Chinese Bitcoin ASIC manufacturers Bitmain, Canaan, and MicroBT, which together account for over 99% of global Bitcoin mining hardware production, are establishing production facilities in the United States.

The move is a direct response to the 25% tariffs on Chinese imports, part of a broader trade policy introduced under former President Trump. Industry experts, including Hashlabs Mining CEO Jaran Mellerud, have warned that such tariffs could significantly dampen U.S. demand for imported mining rigs, potentially benefiting miners in other regions by driving down global prices.

Despite these challenges, the U.S. remains a key growth market for Bitcoin mining, prompting the leading manufacturers to localize production as a way to preserve access and limit regulatory and economic disruptions.

Bitmain in particular has experienced firsthand the complications of U.S. customs scrutiny, with 10,000 of its ASICs seized in late 2024 due to an investigation into a Chinese chipmaker linked to a U.S.-sanctioned firm. Although those units were eventually released, the incident underscored the risks of relying solely on Chinese-based manufacturing and export channels.

It remains uncertain whether U.S.-based production will match China's efficiency or pricing, but for now, the shift marks a significant realignment in the global Bitcoin mining supply chain driven by geopolitics.

🇵🇾 How a Fake Tweet from Paraguay Briefly Sent Bitcoin to $110K

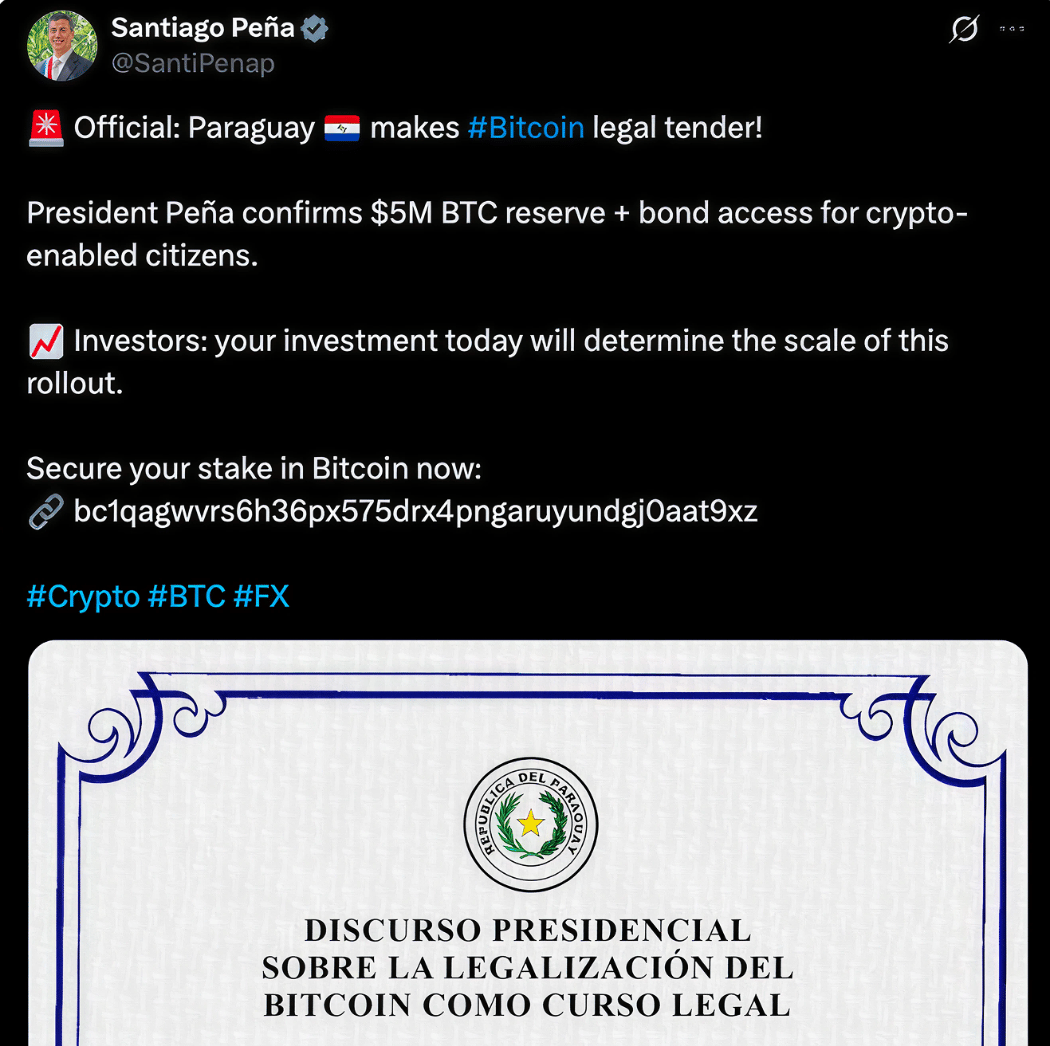

On June 10, 2025, a fake tweet from the compromised X account of Paraguayan President Santiago Peña falsely announced that Paraguay had officially adopted Bitcoin as legal tender and established a $5m Bitcoin reserve.

Despite being quickly debunked by the Paraguayan government due to its unusual English language and a suspicious wallet address for staking, the tweet triggered a rapid 4% surge in Bitcoin's price, pushing it to a local high of $110,450.

This price jump wasn't solely due to the hoax; it coincided with other bullish macroeconomic signals, including positive US-China trade talks, the passage of the bipartisan CLARITY Act clarifying crypto regulatory authority in the US, and major exchanges like Gemini and Coinbase securing MiCA licenses in Europe.

This incident is not isolated, as high-profile social media accounts have been hacked to manipulate crypto markets before. Past examples include the coordinated 2020 hack of prominent figures like Barack Obama and Elon Musk for Bitcoin donations, the 2021 hack of Indian Prime Minister Narendra Modi's account with a false legal tender claim, and the 2024 compromise of the SEC's X account falsely announcing a spot Bitcoin ETF approval.

These hacks are typically part of pump-and-dump schemes or direct scams, though the Paraguayan incident's wallet address showed minimal activity, suggesting a primary goal of market influence.

The rapid market reaction highlights the fast, global, and emotionally driven nature of crypto markets, where algorithmic trading bots quickly react to keywords like "legal tender," amplifying price movements before human fact-checking. Paraguay's existing reputation for being crypto-friendly due to its cheap hydroelectric power lent a deceptive plausibility to the fake announcement.

This event underscores the fragility of trust in social media and how centralized communication channels can become attack vectors in decentralized finance. It also demonstrates the significant symbolic weight that official legal tender adoption carries, despite Bitcoin's increasing institutional adoption.

The market's strong reaction to a hoax suggests that the crypto space, while maturing, remains highly reactive. As of mid-June 2025, Paraguay has no official plans to adopt Bitcoin as legal tender, despite its favorable energy profile for mining. Other Latin American nations are exploring crypto adoption more cautiously, focusing on regulatory frameworks or CBDCs rather than full legal tender status.

⚡️ Bitcoin Mining Costs Top $70K as Energy Prices Rise

The median cost of mining a single Bitcoin has climbed above $70,000 in the second quarter of 2025, marking a nearly 9% increase driven by a rising network hashrate and higher energy prices.

After starting at around $52,000 in the last quarter of 2024, production costs rose to $64,000 in the first quarter and have continued upward. This increase puts pressure on less efficient miners as profit margins tighten, although Bitcoin’s price near $107,000 still provides some cushion for most.

Public mining companies are focusing on keeping operational costs low, especially by managing their fleet hashcost, but some firms like Terawulf and Bitdeer have seen production costs rise by more than 25% due to soaring energy prices.

Difficulty recently dipped slightly after reaching an all-time high, reflecting ongoing challenges for miners amid rising computational demands and operational costs.

🗞️ In the News

Bitdeer plans to offer $330m in senior convertible notes to fund the expansion of its data centers and the development of ASIC mining rigs, especially in the US, to mitigate potential trade tensions.

Canadian agriculture firm AgriFORCE has launched a Bitcoin mining site in Alberta powered by stranded natural gas, operating 120 rigs at 32 PH/s, with plans to expand to two more sites and potentially use half of mined BTC for treasury and growth.

Health tech firm Semler Scientific aims to significantly increase its BTC holdings from 3,800 BTC to 105,000 BTC by 2027, leveraging equity, debt financing, and operational cash flow, and has appointed a new director to spearhead this strategy.

Four publicly traded U.S. firms, DDC Enterprise, Fold Holdings, BitMine Immersion Technologies, and Eyenovia, have committed a combined $844m to cryptocurrency investments, with DDC and Fold targeting large-scale Bitcoin acquisitions and Eyenovia becoming the first public company to add Hyperliquid’s HYPE token to its treasury, signaling a growing trend of corporate crypto adoption.

📰 Miner Update

🐝 HIVE

HIVE Digital Technologies has surpassed 11.4 EH/s in global Bitcoin mining hashrate, completing Phase 1 (100 MW) of its Paraguay Yguazú site ahead of schedule. The company is on track to reach 25 EH/s by American Thanksgiving 2025.

HIVE increased its installed hashrate by about 1 EH/s per week over the past five weeks, now maintaining around 11.5 EH/s.

Seasonal temperature changes in Canada may cause minor fluctuations in hashrate as ASICs are optimized.

Expansion in Paraguay focuses on sustainable growth using 100% renewable hydroelectric power in line with U.S. interests.

Phase 2 is underway with new Bitmain S21+ Hydro ASICs arriving, aiming to reach 18 EH/s by late summer.

The company remains confident in meeting the 25 EH/s target by Thanksgiving 2025.