- Block Green Industry Weekly

- Posts

- "BlackBerry Patents vs. Bitcoin Miners" - Lawsuit Rocks Crypto

"BlackBerry Patents vs. Bitcoin Miners" - Lawsuit Rocks Crypto

PLUS miner news and May updates from MARA, Riot, CleanSpark and Cango

🧌 Patent Troll Targets Bitcoin Legal Battle for Miners

Malikie Innovations, a firm that acquired 32,000 patents from BlackBerry in 2023, has initiated lawsuits against prominent Bitcoin mining companies, Marathon Digital and Core Scientific.

The core of the legal dispute centers on Malikie's claim that these miners are infringing on its patents related to Elliptic Curve Cryptography (ECC), a foundational cryptographic method used by the Bitcoin blockchain.

While individual Bitcoin users are unlikely targets due to their limited financial exposure, the lawsuits pose a significant threat to large-scale mining operations, potentially leading to substantial royalty payments or even bankruptcy for the defendants if Malikie prevails.

Legal experts suggest that a victory for Malikie could set a dangerous precedent, enabling them to pursue other US-based miners, potentially destabilizing the Bitcoin network's security.

However, some legal analysts believe that Malikie, often characterized as a "patent troll," is more likely seeking a settlement rather than a full-scale legal battle aimed at dismantling the industry, especially if the asserted patents are expired or predate Bitcoin's ECC implementation.

Furthermore, questions remain regarding whether the miners, by utilizing open-source technology, are indeed infringing on the patents. This legal challenge echoes past intellectual property disputes targeting Bitcoin, such as Craig Wright's unsuccessful attempts to claim ownership of the Bitcoin white paper and core technology.

🗞️ In the News

IMF has expressed concerns over Pakistan's allocation of 2,000 MW of electricity for Bitcoin mining and AI data centers, questioning the plan's legality and potential impact on energy resources amidst ongoing financial program negotiations.

Tether and Bitfinex have transferred approximately $3.9b worth of BTC to Jack Mallers' Twenty One Capital, making it the third-largest corporate BTC holder globally.

Stax Capital Partners proposes to build Alaska's first large-scale Bitcoin mining operation on the North Slope, fueled by abundant stranded natural gas, with an initial 50MW capacity, aiming to become the nation's largest while facing environmental concerns and logistical challenges.

🩺 Miner Reports

🏃 MARA

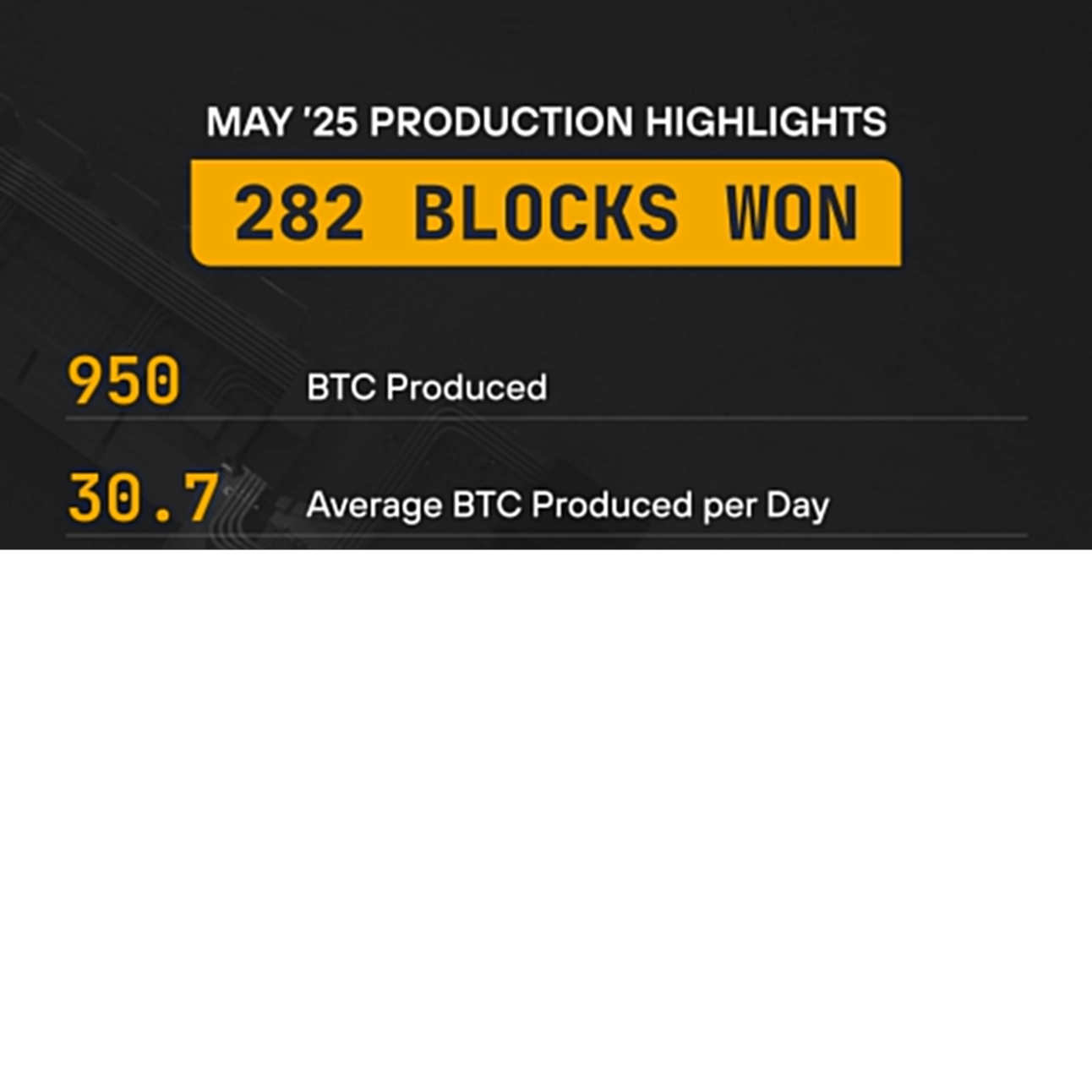

MARA saw a record-breaking May, producing 950 BTC, a 35% increase from April, and earning 282 blocks, up 38% MoM.

BTC holdings have now surpassed 49,000 BTC, reaching 49,179 BTC by the end of May. MARA's Chief Financial Officer confirmed that the company sold zero BTC during May.

MARA's CEO, Fred Thiel, highlighted the company's self-owned and operated mining pool as a key differentiator, providing greater control and efficiency.

Operating their own pool allows MARA to retain the full value of block rewards by avoiding fees to external operators.

May's production also benefited from "block reward luck," with MARA Pool outperforming the network average by over 10% since its launch.

👮♀️ Riot

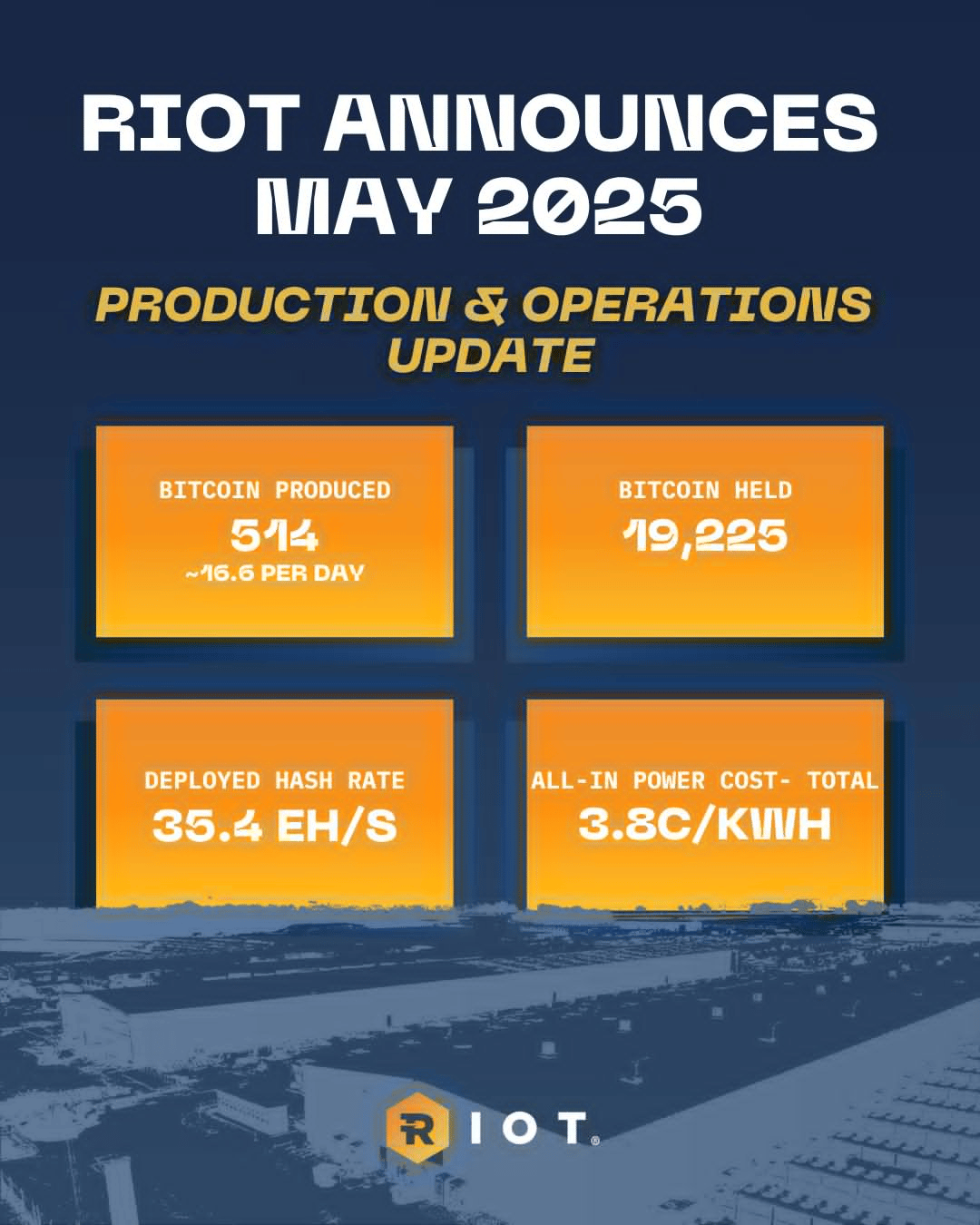

Riot Platforms mined 514 BTC in May 2025, marking an 11% increase MoM and a substantial 139% rise YoY.

The company's total BTC holdings reached 19,225 BTC as of May 31, representing a 112% year-over-year increase.

Riot sold 500 BTC in May, generating $51.3 m in net proceeds, with an average net price of $102,591 per BTC.

The deployed hashrate for Riot increased by 5% month-over-month to 35.4 EH/s, and its average operating hashrate rose by 7% to 31.5 EH/s.

Riot successfully acquired an additional 355 acres near its Corsicana site, which will support the development of datacenters for high-performance compute.

Riot also made key hires, including Jonathan Gibbs as Chief Data Center Officer, to enhance internal development expertise for its new data center platform.

🫧 CleanSpark

CleanSpark significantly increased its BTC production in May, mining 694 BTC, a 9% MoM.

CleanSpark's BTC treasury more than doubled YoY, reaching 12,502 BTC, all generated from mining operations without equity issuance since November 2024.

The company boosted its month-end operating hashrate to 45.6 EH/s and expanded its contracted power capacity to 987 MW

CEO Zach Bradford emphasized that May was a strong execution month, highlighting improved average fleet efficiency and disciplined capital management.

CleanSpark sold 293.5 BTC in May at an average price of approximately $102,254, generating about $30m in gross revenue.

The company reported $182m in Q2 2024 revenue but posted a net loss of $139m for the same quarter.

CleanSpark aims to become the first public Bitcoin miner to achieve 50 EH/s entirely through self-operated infrastructure and plans to reach over 60 EH/s.

⛓️ DMG

DMG Blockchain Solutions mined 31 BTC in May 2025, an increase from 30 BTC in April, with a realized hashrate of 1.89 EH/s.

Reached 2.1 EH/s hashrate target in early May but subsequently reduced hashrate in response to rising temperatures and hydro infrastructure challenges.

DMG's treasury remained stable at 350 BTC by the end of May, as it sold some to cover operating expenses and reduce its loan balance.

CEO Sheldon Bennett noted that despite seasonal headwinds and infrastructure issues, the company maintained stable BTC production and is making progress in securing colocation and off-take agreements for AI infrastructure, as well as new clients for its custody subsidiary.

🦘 Cango

Cango produced 954.5 BTC, valued at over $100m, in April and May, marking its full transition to Bitcoin mining after selling its legacy China operations.

The company operated at an average hashrate of nearly 30 EH/s during this period.

Cango's co-founders have also agreed to sell 10 million Class B shares to Enduring Wealth Capital for $70m, a deal that will give Enduring Wealth Capital voting control of the company upon shareholder approval.