- Block Green Industry Weekly

- Posts

- Bitcoin Surges Above $94,000 Amid Massive ETF Inflows and Institutional Confidence

Bitcoin Surges Above $94,000 Amid Massive ETF Inflows and Institutional Confidence

PLUS Miner news and updates from HIVE

📈 Bitcoin Surges Above $94,000 as ETF Inflows Signal New Era for Bitcoin

On April 22, US spot Bitcoin ETFs saw over $912m in net inflows, marking their highest daily investment since January. This surge in investments signals a recovery in investor sentiment, which had been dampened by global trade concerns.

Analysts, including Ryan Lee from Bitget Research, suggest that macroeconomic factors like a weakening dollar and rising gold prices have made Bitcoin more attractive as a hedge against volatility.

As Bitcoin strengthens, fueled by strong ETF inflows, institutional acquisitions, and a softening dollar, its role as a safe-haven asset is becoming clearer. Nexo analyst Iliya Kalchev highlighted how Bitcoin is emerging from the shadows of tech stocks, with a shift in how it’s perceived amidst economic uncertainty.

Nansen CEO Alex Svanevik noted Bitcoin’s evolution into a more stable, gold-like asset. However, concerns over a potential recession could cap its price trajectory. BitMEX co-founder Arthur Hayes even suggested that Bitcoin’s price might not drop below $100,000 again, with upcoming US Treasury buybacks potentially acting as a catalyst for further price increases.

This shift in Bitcoin's status marks a new chapter in its maturity as an asset, positioning it at the forefront of the ongoing financial recalibration. Read more

🌎️ Bitcoin Miners Scramble as U.S. Customs Tightens Scrutiny Amid Rising Tariffs

Some Bitcoin mining companies have been underreporting the value of their ASIC shipments to U.S. Customs in order to avoid paying customs duties, a practice that has become more significant with the recent increase in tariffs under the Trump administration.

These companies often declare lower values for shipments, reducing import taxes, though this is risky and illegal. As U.S. Customs has begun paying closer attention to these shipments, particularly in light of investigations into sanctions violations, it has become harder to evade scrutiny.

The enforcement of tariffs has been inconsistent across different states, with some locations facing stricter controls than others. The new tariffs on goods from Southeast Asia have added further uncertainty for miners, some of whom are now re-evaluating their plans due to the potential for higher costs.

While some miners continue to forge ahead, others are delaying shipments or reconsidering their strategies, with some looking to relocate projects to jurisdictions like Canada to avoid high tariffs.

🗞️ In the News

Riot Platforms secured a $100m BTC-backed loan from Coinbase to fund operations and growth initiatives, leveraging its substantial 19,223 BTC holdings as collateral.

Bitdeer secured $60m in funding and entered a loan agreement with affiliate Matrixport, accessing a $200m facility backed by its Sealminer hardware, with $43m drawn as of April 21.

The LAPD recovered $2.7m worth of Bitcoin mining rigs stolen from Los Angeles International Airport, arresting two individuals believed to be part of a South American crime ring and seizing an additional $1.2m in other stolen goods.

The Kuwait Ministry of Interior has issued a warning after identifying over 1,000 illegal mining sites, highlighting concerns about power outages and safety risks, despite the country’s ban on crypto mining since July 2023.

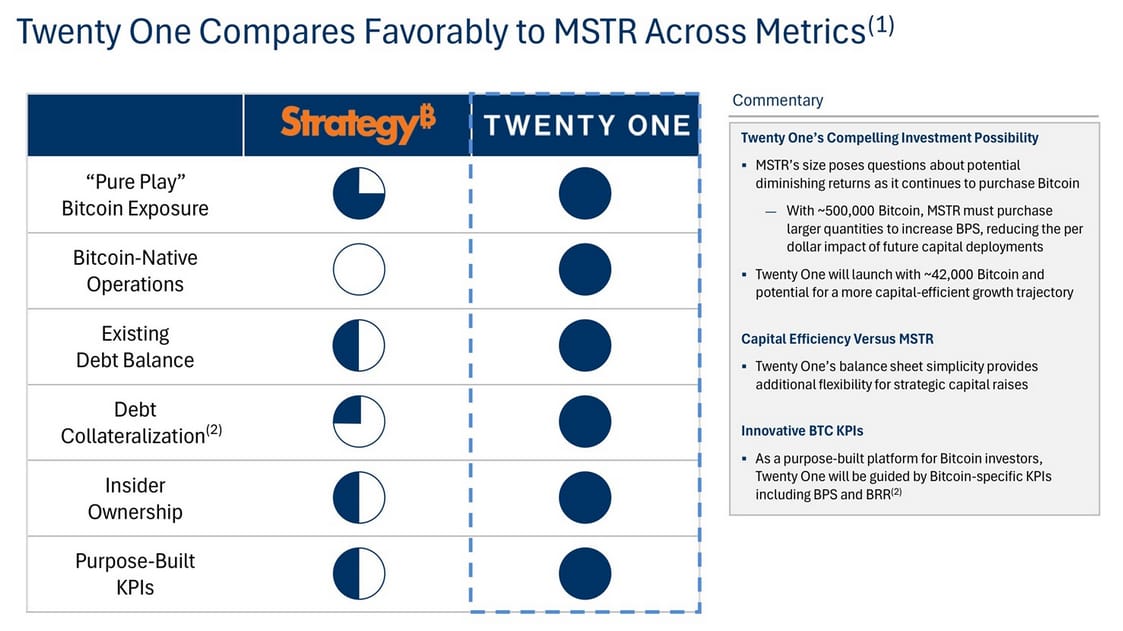

Strike's Jack Mallers is leading a new Bitcoin treasury firm, Twenty One Capital, backed by major players, to rival MicroStrategy by going public with a substantial Bitcoin holding and plans for diverse Bitcoin-related services.

Tesla reported holding nearly $1b in BTC as of March 31, 2025, with no recent transactions.

🐝 HIVE Completes 100 MW Phase 1 Infrastructure in Paraguay and Expands Operations Team

HIVE Digital Technologies has completed Phase 1 of its Yguazù facility in Paraguay, a 100 MW data center supported by a 200 MW substation, enabling 5 EH/s capacity for next-gen ASIC miners.

200 PH are operational with BUZZ Miners, and 8,000 more are expected online by the end of April. Over 20,000 Bitmain S21+ units will arrive by May.

The company plans to scale to 5 EH/s in Paraguay and 11.5 EH/s total by Q2 2025, aiming for 25 EH/s by Fall 2025 to produce 12+ BTC daily.

HIVE secured deposits for 4.3 EH/s of Bitmain S21+ miners, fully funding its expansion from 6.5 EH/s to 11.5 EH/s without debt.

The company is racking and energizing machines at the Paraguay site, driving growth momentum.

HIVE appointed Carlos Anibal Torres as Paraguay Operations & Project Manager to support regional expansion.