- Block Green Industry Weekly

- Posts

- Bitcoin Hashrate Drops 15% Amid Iran Tensions and Heatwave

Bitcoin Hashrate Drops 15% Amid Iran Tensions and Heatwave

PLUS miner news and HIVE FY 2025

📉 Bitcoin Hashrate Drops 15% Since Mid-June in Largest Decline in Three Years

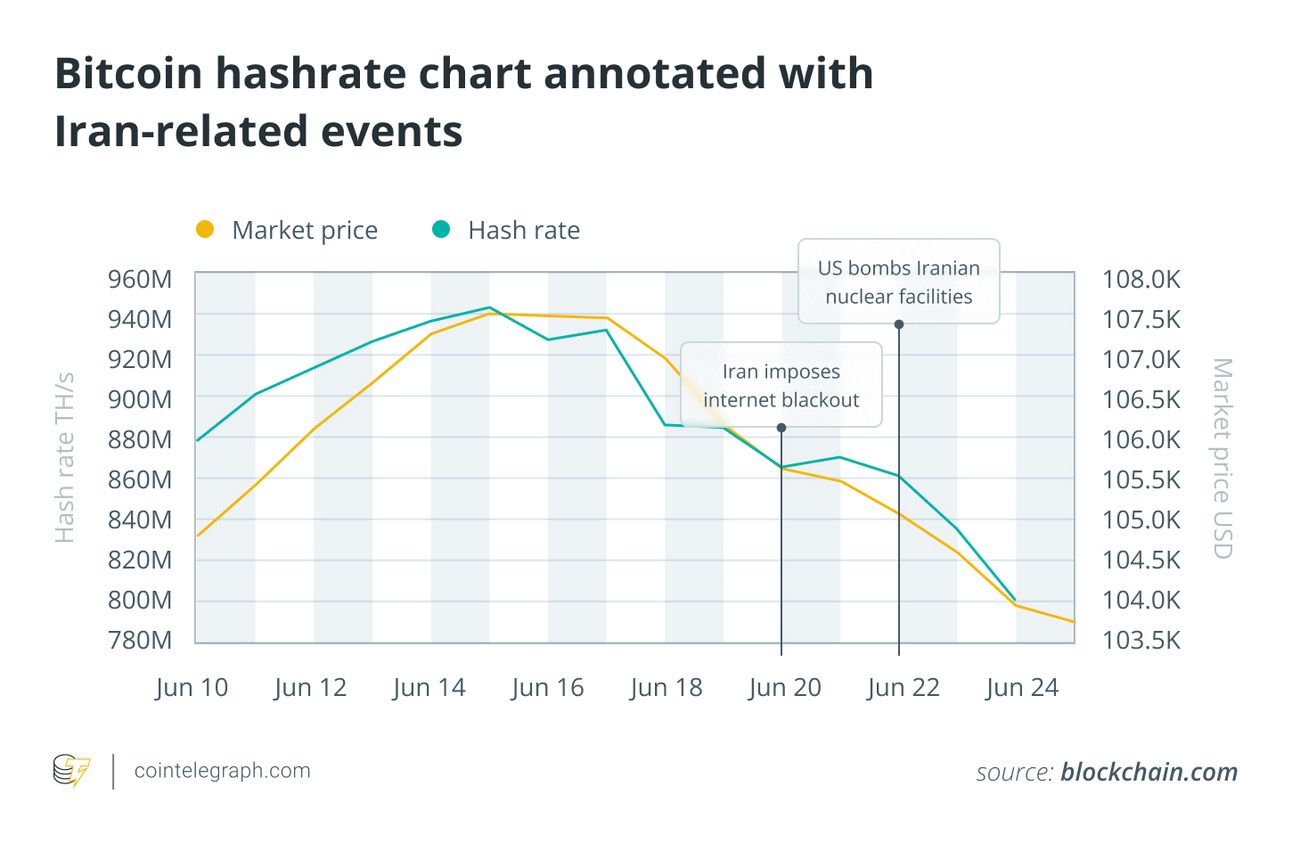

Bitcoin’s hashrate has dropped over 15% since June 15, the steepest decline in three years, sparking speculation about underlying causes.

While some point to Iran, where state-linked mining operations and recent power outages coincide with parts of the decline, only a small portion aligns directly with those events.

The broader trend began before Iran’s internet blackout and U.S. strikes on Iranian infrastructure, suggesting other contributing factors. Heatwaves in the U.S. have raised electricity prices and lowered mining efficiency, likely prompting shutdowns at less profitable sites.

Analysts caution against over-interpreting single events. Most observers agree that a mix of geopolitical tension, environmental strain, and economic pressures is driving the downturn.

🗞️ In the News

Core Scientific shares surged 35% after reports that AI infrastructure firm CoreWeave is in talks to acquire the Bitcoin miner, deepening a $10.2b partnership as Core pivots toward AI hosting.

Cipher Mining has started BTC production at its 300 MW Black Pearl data center in Texas, reaching an initial hashrate of 2.5 EH/s with plans to scale up to 9.6 EH/s by Q3 and a total self-mining capacity of 23.1 EH/s once fully operational.

Hut 8 has doubled its BTC-backed credit facility with Coinbase to $130m, securing improved terms and a fixed 9% interest rate to support non-dilutive growth across its digital infrastructure and Bitcoin mining operations.

HIVE Digital Technologies has acquired a 7.2 MW data center in Toronto to support its BUZZ HPC subsidiary, advancing its plan to build sovereign, liquid-cooled AI infrastructure in Canada for government and enterprise use.

CleanSpark has become the first publicly traded miner to reach 50 EH/s of fully self-operated hashrate, leveraging its vertically integrated infrastructure and treasury strategy to drive non-dilutive growth and prepare for expansion beyond 60 EH/s.

Bit Digital has announced a strategic shift to focus exclusively on Ethereum staking and treasury operations, planning to divest its Bitcoin mining assets and convert its BTC holdings into ETH to support its new direction.

Bit Digital’s stock dropped 15% in a day and nearly 19% on the week, after announcing a $150m public share offering and a strategic pivot from Bitcoin mining to Ethereum staking.

📰 Miner Update

🐝 HIVE FY 2025

HIVE reported FY2025 revenue of $115.3m and Adjusted EBITDA of $56.2m. The company mined 1,414 BTC during the year, generating $105.2m in mining revenue, down 5.2% YoY.

HIVE’s AI and high-performance computing (HPC) segment generated $10.1m in revenue, tripling YoY.

Gross operating margin for the year was $25.1m (21.8%), while the company posted a GAAP net loss of $3.0m.

As of March 31, 2025, HIVE held 2,201 BTC valued at $181.1m and had achieved a hashrate of 6.3 EH/s, up from 4.5 EH/s at the end of FY2024.

During FY2025, HIVE acquired 300 MW of hydro-powered energy assets in Paraguay, 100 MW in Valenzuela and 200 MW in Yguazú, to support long-term mining and HPC operations.

By June 26, 2025, the company’s hashrate reached 11.5 EH/s, with daily Bitcoin production at 5.5 BTC, and it reaffirmed its target of 25 EH/s by Thanksgiving 2025.

HIVE delivered a 22% return on invested capital (ROIC) for the fiscal year, maintaining one of the industry’s lowest G&A costs per BTC mined.

In Q4 FY2025, the company generated $31.2m in revenue, $28.1m from mining and $3.0m from BUZZ HPC, while mining 303 BTC.

Q4 gross margin came in at $8.8m (28.2%), but GAAP net loss was $52.9m. Adjusted EBITDA for Q4 was -$30.7m.